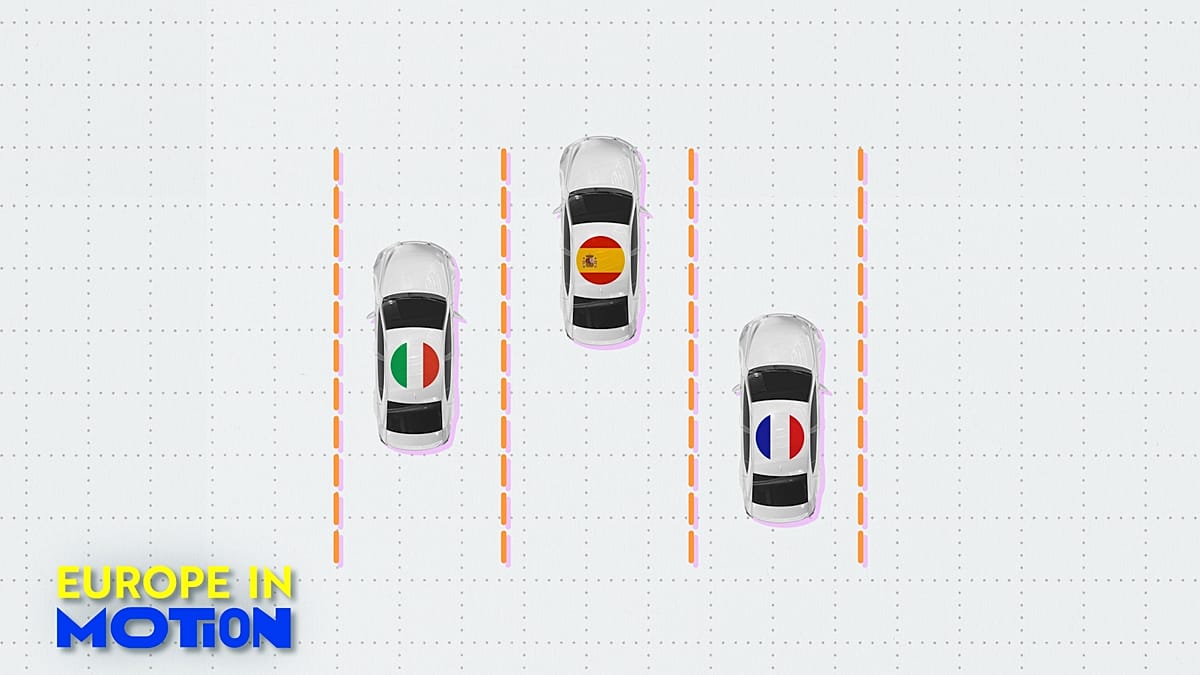

Spain has been decisively leading Europe’s car market during the first nine months of 2025.

Madrid reported a remarkable 15% growth in new passenger car registrations between January and September, the highest in Europe, according to new data by the International Council on Clean Transportation (ICCT).

One of the reasons was a €400 million extension of a massive EU incentive scheme — Moves III — aimed at boosting electric mobility.

The programme, now open till the end of 2025, has spent more than €1.3 billion in the past four years — not just for purchasing vehicles, but also to install over 100,000 charging points across the country.

Austria also recorded an impressive 12% increase in the first nine months of the year.

However, experts say the increase in fully electric vehicles was mostly (70%) fuelled by corporate fleets, making the trend potentially volatile, depending on purchasing cycles.

The country’s decision to axe incentives for individuals purchasing BEVs (battery electric vehicles), as Euronews Business reports, may also lead to lower demand in the coming months.

In general, 2025 hasn’t been the greatest year for the European car market.

New passenger car registrations grew by a mere 1% between January and September compared to the same period in 2024, the ICCT said.

A total of just more than 8.2 million vehicles were sold, but the picture varies significantly between countries, which also include non-EU members Iceland, Liechtenstein and Norway.

Sales dropped in Belgium (-9%), France (-6%), Italy (-3%) and stagnated in Germany (0%).

However, Europe’s automotive industry is not doomed to decline, analysts at the Jacques Delors Centre say.

“Recent national initiatives demonstrate that well-designed industrial policies can attract investment, revitalise legacy production clusters, and build new BEV value chains”, the institute said in an analysis of Europe’s car industry transition.

“What’s missing is a coordinated European strategy to turn so far disparate efforts into a lasting and collective competitiveness.”

“Attributing the stuttering BEV transition solely to reluctant consumers oversimplifies the problem, obscuring more actionable barriers to adoption — chiefly persistent price premiums over ICE vehicles and erratic policy signals,” the analysts added.

Read the full article here