You could be losing money to subscriptions you don’t even use. This popular budgeting app can help you cut costs.

No one likes losing money, yet many of us are allowing dollars to drain from our bank accounts without realizing it. The average US consumer spends around $200 a year on subscriptions they don’t even use, according to a recent CNET study.

It’s easy to see why. You sign up for a free trial or service and forget about it, but the subscription provider keeps charging you each month. Since the money is automatically deducted from your account, you don’t pay much attention to it. Or maybe you’ve thought about canceling, but you keep putting it off because you don’t want to deal with the hassle.

Whatever the reason, you don’t have to let unwanted subscriptions siphon away your hard-earned cash. After hearing numerous podcast ads touting Rocket Money’s ability to save me on subscriptions, I decided to test out the budgeting app to see if the hype was warranted. After it saved me $400 in 15 minutes, I’d say it is.

Not only can it help you rein in your spending, but Rocket Money can also help you find and cancel unwanted subscriptions.

Details

How Rocket Money slashed $400 from my budget in 15 minutes

Rocket Money is a budgeting app that monitors your income and expenses, helps you set savings goals and tracks your subscriptions in one place, whether you use the free or paid version. It’s also CNET’s Editors’ Choice for best budgeting app. Rocket Money’s paid version, which costs $6 to $12 a month, can also find and cancel some subscriptions for you.

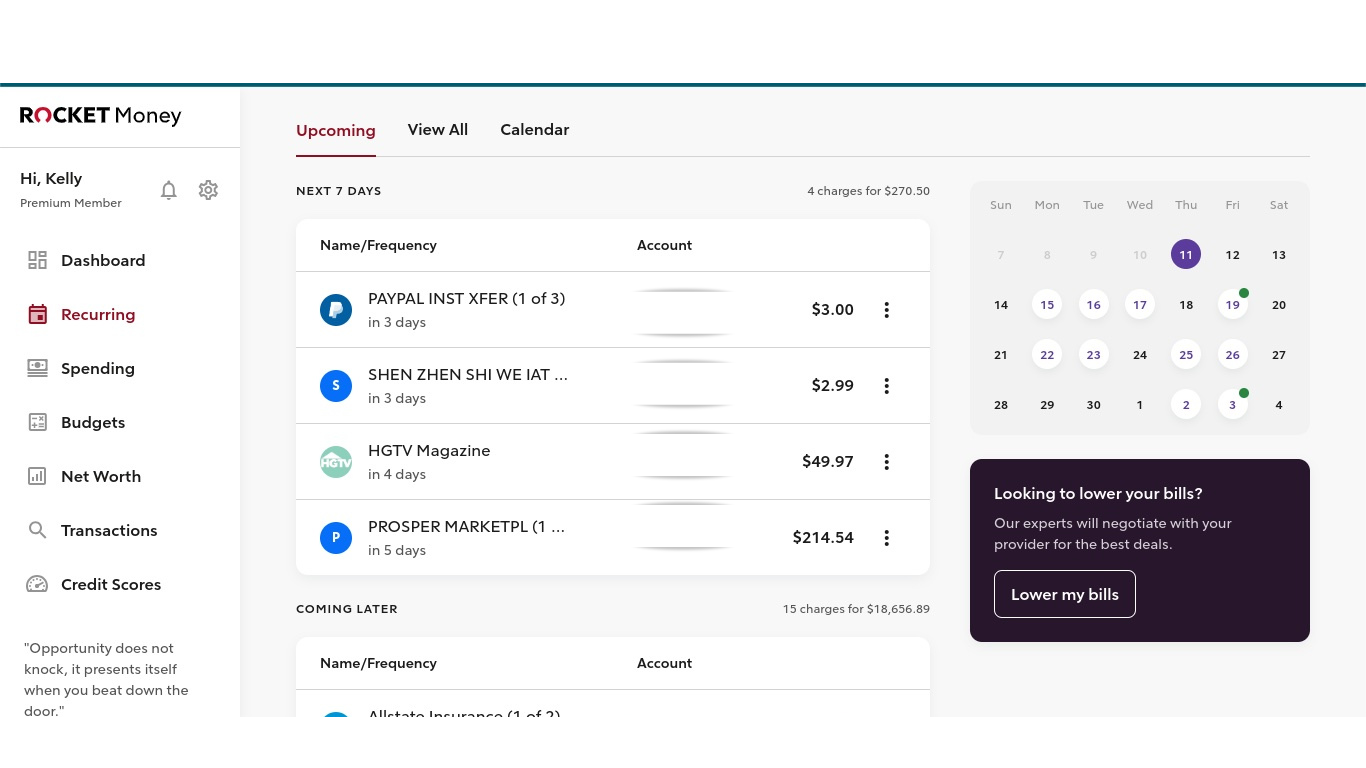

You can try this service by navigating to the Recurring tab on the app menu. You’ll see subscriptions coming due in the next seven days, ones coming due later and how much you spend on these subscriptions in a year.

The first thing I noticed was that my subscription to HGTV Magazine, which costs $50 for a year, was up for renewal in four days. Given my enormous pile of unread back issues, canceling this subscription was a no-brainer.

Rocket Money gave me two options: The app could cancel this subscription for me or I could call the number they provided to cancel it myself.

I chose to have them do it for me. The app asked for some basic information, including my name, billing address and the reason I wanted to cancel, then confirmed that it was working on it.

The process was fairly painless but I have one complaint. I didn’t know until after I’d submitted my cancellation request that it could take two to seven days for Rocket Money to complete the cancellation — I found out from the pop-up confirmation I received after submitting. Fortunately, I was able to respond quickly to the email confirmation Rocket sent me and I received a response within minutes from a customer support rep who said they’d fast-track my cancellation. The next business day, my subscription was canceled.

I was hooked. What else was I spending money on without realizing it? I reviewed my other subscriptions and identified a handful I no longer needed:

- HP Instant Ink: $4.34 a month (for a printer I don’t even have anymore)

- New York Times Digital: $4 a month (the number of free articles I get is usually enough for me)

- Wall Street Journal: $4 a month (same as above)

- Pandora: $10 a month (a recent switch to Amazon Prime Unlimited made this service unnecessary)

- Spotify: $10 a month (same as above)

I’ll admit I barely noticed these small amounts when they hit my bank account each month. I’d grouped them under “Miscellaneous” in my budget and never really thought about them because that category tended to stay within my spending goals. But viewing them all grouped together, it was easy to see how quickly they could drain my budget.

By canceling these subscriptions, I saved myself $32.32 a month going forward, for a total annual savings of $387.84. Add that to the savings on my HGTV Magazine subscription and that’s an extra $437.81 in my pocket annually.

Better yet, even though I’d only installed the app a few months earlier, Rocket Money pulled in subscriptions from years past, allowing me to catch ones that were coming due even though I hadn’t paid for them since installing the app.

In total, reviewing my subscriptions and having Rocket Money cancel six of them took me about 15 minutes. Not bad to get more than $400 in savings.

You can also save on subscriptions with Rocket’s free version

Rocket Money’s free version only shows subscriptions — it won’t cancel them for you. To access the cancellation service, you’ll need the paid version, which costs $6 to $12 a month. You choose your amount, and you’ll enjoy the same features regardless of how much you pay.

If you don’t want to pay extra for the convenience of having Rocket cancel your subscriptions for you, you could just as easily use the free version to identify your subscriptions and then cancel them yourself.

You can also try using Rocket’s bill negotiation service, which can help lower your monthly costs, but you’ll pay 35% to 60% of your first year’s savings if it’s able to save you money.

Other ways to cut subscription costs

I used Rocket Money to trim my subscription costs because it’s the budgeting app I regularly use anyway. I’d rather save a few minutes, especially if it doesn’t cost me anything extra.

But you can always cancel your subscriptions yourself by calling a customer service line or logging into your online account.

These tips can also help you maximize your savings:

- Note your renewal dates. Whenever you sign up for a new service, note when it’s due to renew. Then, set a reminder on your calendar for the week before so you can decide if it’s worth renewing and cancel if not. If you sign up for a free trial, use a virtual card to make canceling a breeze.

- Review your budget regularly. Going over your budget weekly can help you spot subscription charges that have already hit your account and cancel them before they cost you more. But don’t just take a cursory glance. Look at each transaction, even the minor ones. I was keeping a general eye on my spending, but I wasn’t always doing it line by line to evaluate if each expense was truly worth it.

- Rotate your streaming services. You can only watch so much content in a month. One of the easiest ways I’ve found to keep my subscription costs down is to only subscribe to one streaming service at a time. For example, when one of the shows I love dropped its new season on Netflix, I canceled my Hulu and signed up for a month of Netflix. I watched everything that interested me on Netflix before the month was up, then I canceled it and moved on to another service.

- Take advantage of complimentary subscriptions. Some subscriptions give you free access to other services. For instance, Walmart Plus members get a free Paramount Plus subscription. Amazon Prime membership comes with perks like a free Amazon Music subscription and a free year of Grubhub Plus. Take a look at your existing subscriptions to see if they offer any free perks you can take advantage of.

- Visit your local library. Many library systems offer free access to newspapers, magazines and movies and TV series on DVD. Check out your local library to see what you can enjoy for free.

- Threaten to cancel. Sometimes, you can score a discount by calling customer service and saying you’d like to cancel your subscription. It won’t always work, but it can’t hurt to try.

Read the full article here