After last year’s election, small business owners were ready to celebrate. The economy hadn’t fallen into recession, inflation was cooling, and consumer spending was holding up. Now the party is on ice. And that was even before Trump’s “Liberation Day” speech promising the stiffest tariffs since 1909.

The National Federation of Independent Business reported Tuesday that its Small Business Optimism Index dropped by 3.3 points in March to 97.4. That’s below the 51-year average of 98 and marks the sharpest monthly decline since June 2022. The gauge is now down 7.7 points since registering a post Covid peak of 105.1 in December of last year.

The last time the index fell this much, small business owners were bracing for a recession. That downturn never came, but the fear alone was enough to dent optimism.

This time, the fear is of a self-inflicted recession.

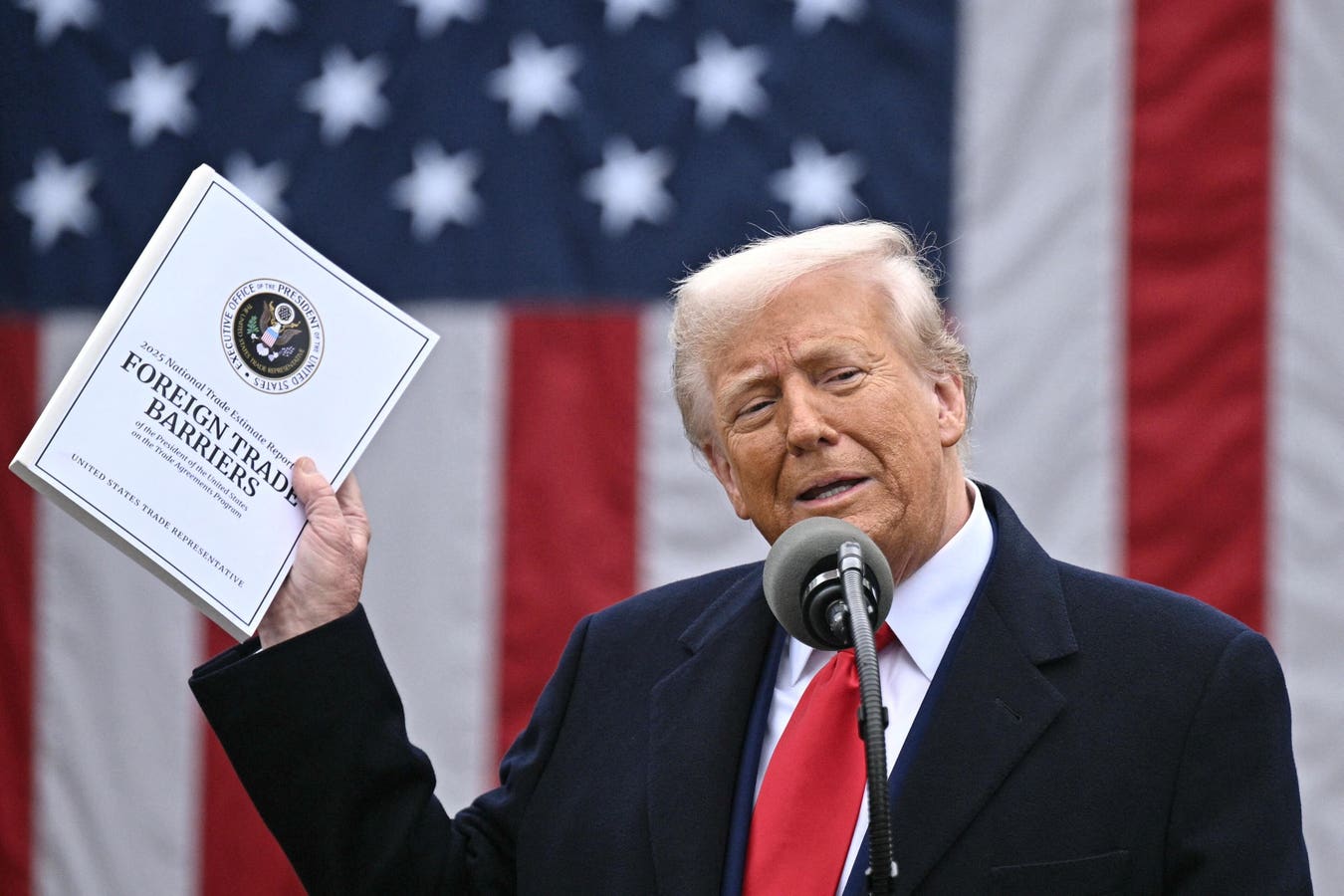

Last month, business owners were trying to figure out what the White House might do next. Survey results show that President Trump’s tariff talk was already weighing on confidence, even before the April 2 rollout. No one knew how high the tariffs would go, how they’d work, or what the goal was. And with the levies set to take effect on April 9, few of those questions have been clearly answered.

Seven of the ten components of the Optimism Index turned negative. Only responses to questions about current job openings and plans to make capital outlays showed improvement since February. The biggest decliners were around expectations of broad improvements to the economy and higher anticipated sales.

No wonder confidence is slipping.

More than two-thirds of small and mid-sized business owners in the U.S. depend on imports to make their products or stock their shelves, according to a March 2024 report from FedEx.

Quality of labor remained the single most important problem, cited by 19% of respondents, according to the NFIB survey. That number hasn’t changed since February. Taxes (which would include tariffs), at 18%, was a close second, jumping from 14% one year ago. Concerns around inflation, however, have cooled, plunging from 25% in March 2024 to 16% this year.

The NFIB’s Uncertainty Index, which measures how unsure owners are about the future by counting “don’t know” and “uncertain” responses to six questions about the economy and their own expansion plans, fell by 8 points, though it remains historically elevated. February’s monthly reading of 104 was the second highest on record, behind only the 110 level it reached in October of last year.

Don’t count on uncertainty falling again next month. The next round of survey results will reflect the fallout from President Trump’s tariff plan, which has roiled global markets and left small business owners scrambling to understand how it will hit their supply chains, pricing, and long-term plans.

Read the full article here