WASHINGTON — President Trump’s handling of the economy has succeeded in bringing some of the biggest increases in a decade or more to tariffs revenue, blue-collar wages and capital investments, a senior Treasury official told The Post.

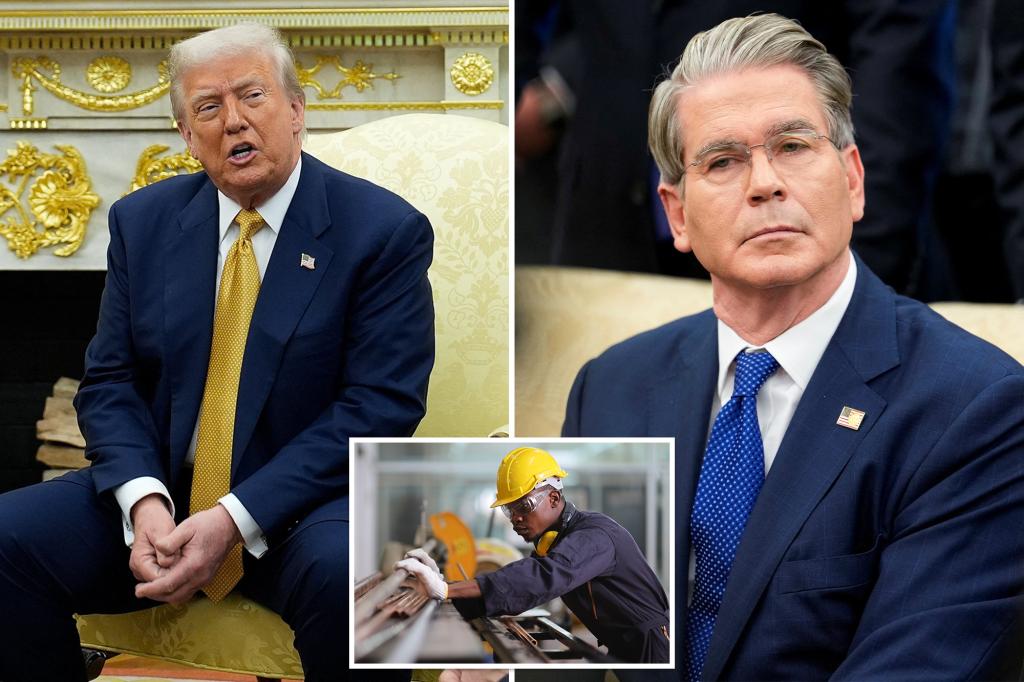

Those “ABCs” — described as “America First” trade, a “Blue-Collar Boom” and a “Capital Expenditures Comeback” — are also rebutting Trump critics who claimed the president’s tax-and-tariff agenda would upend the global economy, said Joe Lavorgna, who serves as counselor to Treasury Secretary Scott Bessent.

As the US agreed to another trade deal with Japan this month, Lavorgna pointed to Treasury revenue from tariffs topping $200 billion in fiscal year 2025 — a record — and approaching “more than $300 billion” by the end of the calendar year.

Blue-collar workers have also seen real wage growth of 1.7% since Trump took office, Bessent previously told Post columnist Miranda Devine on “Pod Force One,” the highest level of any presidential administration since at least Richard Nixon.

“These are … the laborers, the backbone of the market,” Lavorgna added. “They didn’t graduate from fancy colleges — in most cases probably they didn’t graduate from college at all — that are punching a time check when they come into work.”

In the first half of the year, he noted, capital expenditures surged 16.6% — the largest two-quarter gain since 1997, excluding the rebound coming out of the COVID-19 pandemic.

Business equipment production also rose 11% (annualized) in the second quarter after jumping 23% in the first quarter of the calendar year.

“We think it’s tied into the One Big Beautiful Bill,” Lavorgna claimed, pointing to provisions that allow businesses to write off production expenses and other investments.

Last week, Trump touted more than $100 billion in investments for the artificial intelligence and energy industries at a summit in Pittsburgh, one of several events that have spurred economic growth.

Japan’s trade deal also pencilled in $550 billion in US-based investments.

“If you have more capital, people can produce more,” he went on. “You’re raising productivity and lending standards, living standards … at the same time, people are taking on bigger paychecks … that reinforces the blue-collar boom.”

The economic shifts are still keeping core inflation to around 2%, while the current consumer price index hit 2.7% over the past year, per the US Bureau of Labor Statistics.

Some trade deals have yet to be inked that could affect those rates — including an anticipated deal with the European Union, which Trump recently threatened with up to 50% duties.

Lavorgna said the largest growth sectors domestically have been in communications equipment, computers and AI.

“As these trade deals have come through and these other countries such as Japan have committed to making major capital investments in the US, it’s clear that the tariffs have had their desired effect,” he said.

“We’ve got the revenues. We haven’t had the inflation, and we’re getting the capital commitments of reshoring here. So to me, it’s a win-win-win.”

Read the full article here